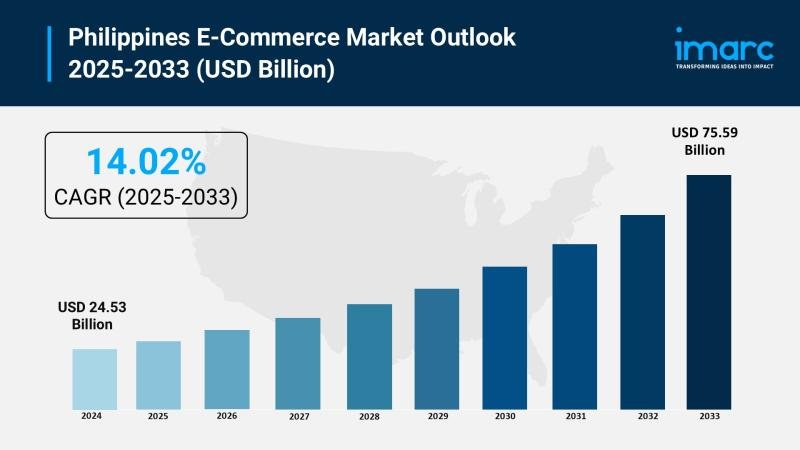

The latest report by IMARC Group, “Philippines E-commerce Market Size, Share, Trends and Forecast by Business Model, Mode of Payment, Service Type, Product Type, and Region, 2025-2033,” provides an in-depth analysis of the Philippines e-commerce market. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Philippines e-commerce market size reached USD 24.53 billion in 2024 and is projected to grow to USD 75.59 billion by 2033, exhibiting a robust growth rate of 14.02% during the forecast period.

Report Attributes and Key Statistics:

Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 24.53 Billion

Market Forecast in 2033: USD 75.59 Billion

Growth Rate (2025-2033): 14.02%

Philippines E-commerce Market Overview:

The Philippines e-commerce market is experiencing transformative growth as expanding retail channels, rising digital payment adoption, and mobile commerce revolution drive unprecedented market expansion. The sector is benefiting from growing investments in user-friendly websites, targeted online marketing strategies, and innovative security features including encryption, two-factor authentication, and biometric verification in digital payment services. Mobile commerce has emerged as the cornerstone of the nation’s digital transformation, with young tech-embracing populations relying predominantly on smartphones for internet access. Lifestyle changes and increasing demand for convenience, particularly in urban locations like Metro Manila, are accelerating online shopping adoption across diverse product categories and consumer segments.

Request For Sample Report: https://www.imarcgroup.com/philippines-e-commerce-market/requestsample

Philippines E-commerce Market Trends:

• Mobile Commerce Domination is accelerating, with Filipino consumers embracing smartphones as their primary shopping device, supported by low-cost mobile data plans and ubiquitous smartphone availability

• Social Commerce Integration is strengthening through platforms like Facebook and TikTok driving sales via live selling events, influencer marketing, and social media product discovery

• Digital Payment Infrastructure Growth is expanding rapidly, with the World Bank approving USD 750 million to improve trust in e-commerce and build advanced payments infrastructure

• Retail Channel Expansion is transforming traditional retailers who are investing heavily in user-friendly websites and targeted online marketing to engage consumers effectively

• Logistics Innovation Advancement is improving delivery speed and reach through regional fulfillment centers, localized sorting facilities, and motorcycle delivery fleets across 7,000+ islands

• Rural Market Penetration is gaining momentum as increasing internet penetration and smartphone adoption create opportunities in smaller cities and outlying towns

• Cross-Border E-commerce Development is emerging as Filipino shoppers demonstrate keen interest in goods from South Korea, Japan, and China, particularly in beauty, electronics, and apparel

Philippines E-commerce Market Drivers:

• Rising Internet Penetration and Smartphone Adoption are enabling seamless online shopping access for consumers across metropolitan areas and rural provinces

• Government Digital Transformation Initiatives including USD 750 million World Bank funding are improving e-commerce trust and building advanced payments infrastructure

• Changing Urban Lifestyles in cities like Metro Manila and Davao are driving convenience shopping demand due to traffic congestion, long commutes, and erratic weather patterns

• Entrepreneurial Culture Expansion is supporting home-based entrepreneurs and online brands leveraging digital channels with minimal entry costs on marketplace platforms

• Digital Wallet Popularity Growth is overcoming convenience and trust barriers through mobile-customized payment solutions and enhanced security features

• Social Media Platform Integration is enabling product discovery and purchase through Facebook, TikTok, Instagram, and live-selling events reaching tech-savvy millennials

• Logistics Infrastructure Development is enhancing delivery reliability and speed through investments in warehousing, route optimization, and regional courier partnerships

Market Challenges:

• Logistics Complexity in Archipelagic Geography presents operational challenges across 7,000+ islands with varying infrastructure development and delivery accessibility

• Digital Payment Gaps and Trust Issues persist among rural consumers and older populations who prefer cash-on-delivery due to unfamiliarity with digital wallets

• Regulatory Uncertainty and Compliance Complexity creates operational risks as government frameworks for online trade, taxation, and consumer protection continue evolving

• Consumer Trust and Fraud Concerns affect adoption rates, particularly regarding lesser-known sellers and platforms with minimal consumer protection features

• Infrastructure Limitations in rural regions including underdeveloped roads, inadequate courier access, and customs clearing delays impact service quality

Market Opportunities:

• Hidden Rural and Provincial Markets offer significant untapped potential as internet penetration and smartphone adoption expand beyond urban centers

• Local Brand Development presents opportunities for homegrown products using local ingredients and reflecting Filipino culture, particularly among socially conscious consumers

• Cross-Border Trade Expansion enables access to Southeast Asian markets and Filipino expatriate communities worldwide seeking authentic local products

• Niche Product Category Growth including eco-friendly products, organic produce, and artisanal goods gaining popularity among underserved market segments

• Social Commerce Platform Innovation through enhanced live-selling capabilities, influencer partnerships, and community-based purchasing programs

• Corporate Digital Transformation as traditional retailers accelerate online channel development and omnichannel integration strategies

Browse Full Report with TOC & List of Figures: https://www.imarcgroup.com/philippines-e-commerce-market

Philippines E-commerce Market Segmentation:

By Business Model:

• B2C (Business-to-Consumer)

• B2B (Business-to-Business)

• C2C (Consumer-to-Consumer)

• Others

By Mode of Payment:

• Payment Cards

• Online Banking

• E-Wallets

• Cash-on-Delivery

• Others

By Service Type:

• Financial

• Digital Content

• Travel and Leisure

• E-tailing

• Others

By Product Type:

• Groceries

• Clothing and Accessories

• Mobiles and Electronics

• Health and Personal Care

• Others

By Regional Distribution:

• Luzon

• Visayas

• Mindanao

Major Market Competitors:

• Shopee Philippines

• Lazada Group Philippines

• Zalora Philippines

• Carousell Philippines

• Sephora Digital SEA Pte Ltd

• IKEA Philippines

• Temu Philippines

• Kimstore Philippines

• Sterling Galleon Corporation

• Local Filipino E-commerce Platforms

Philippines E-commerce Market News:

May 2025: The World Bank Board of Directors approved a USD 750 million second digital transformation development policy loan for the Philippines to improve trust in e-commerce and build advanced payments infrastructure. This significant investment is designed to strengthen digital payment systems, enhance cybersecurity measures, and support the government’s initiative to promote a cashless economy across the archipelago.

June 2025: Industry analysis revealed that mobile commerce has become the dominant force in Philippine e-commerce, driven by the nation’s young, tech-embracing population who rely predominantly on smartphones for internet access. Social media platforms like Facebook and TikTok are revolutionizing sales through live selling events and influencer marketing, while digital wallets are experiencing unprecedented adoption rates among Filipino consumers.

Key Highlights of the Report:

• Comprehensive market analysis projecting exceptional growth from $24.53 billion in 2024 to $75.59 billion by 2033

• Detailed examination of mobile commerce revolution with smartphones becoming the primary shopping device for Filipino consumers

• Strategic assessment of USD 750 million World Bank digital transformation investment improving e-commerce infrastructure and trust

• In-depth analysis of social commerce integration through Facebook, TikTok, and live selling events driving sales growth

• Logistics innovation evaluation covering delivery solutions across 7,000+ islands including regional fulfillment centers and motorcycle fleets

• Rural market penetration opportunities analysis highlighting untapped potential in provincial areas with growing internet connectivity

• Cross-border trade development assessment showing Filipino consumer interest in South Korean, Japanese, and Chinese products

Frequently Asked Questions (FAQs):

Q1: What are the primary drivers behind the Philippines e-commerce market’s robust 14.02% growth rate?

A1: The market is driven by rising internet penetration, widespread smartphone adoption, and mobile commerce dominance among Filipino consumers. Government initiatives including USD 750 million World Bank funding for digital infrastructure, changing urban lifestyles demanding convenience, and social media platform integration through Facebook and TikTok are significantly contributing to market expansion.

Q2: How is mobile commerce transforming the Philippine e-commerce landscape?

A2: Mobile commerce has become the cornerstone of Philippine e-commerce, with young tech-savvy consumers relying predominantly on smartphones for shopping. Low-cost mobile data plans, ubiquitous smartphone availability, and social media platform integration enable seamless online transactions. Digital wallets and mobile payment solutions are overcoming traditional trust barriers while live selling events create engaging shopping experiences.

Q3: What opportunities exist in rural and provincial markets for e-commerce expansion?

A3: Rural markets represent significant untapped potential as internet penetration and smartphone adoption expand beyond urban centers. These regions often have restricted access to physical retail stores, making online shopping an attractive solution for specialty items and branded products. Platforms adapting logistics and payment methods to rural needs, including cash-on-delivery and community pick-up locations, can build loyal customer bases.

Note: If you require specific information not currently within the scope of the report, we can provide it as part of the customization.

Ask an analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=28734&flag=C

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: Sales@imarcgroup.com

Tel. No.: (D) +91 120 433 0800

Americas: +1 201-971-6302

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.